Documents, Fees & Taxes

Closing Costs

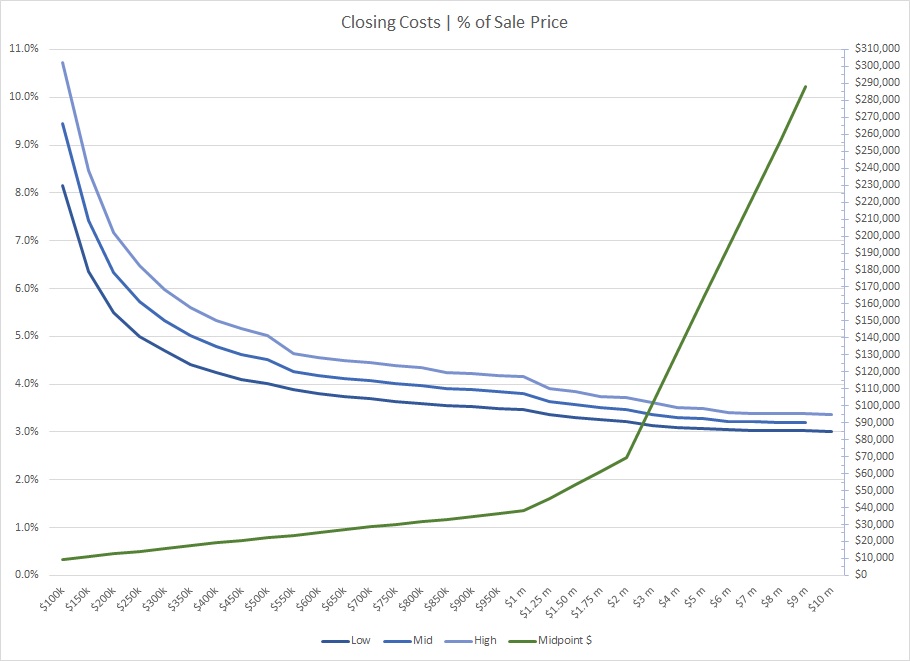

Closing costs in Mexico can typically range between 3% – 10% (including Real Property Transfer Tax) or more, depending on the property purchase price. To clarify, closing costs are in addition to your Earnest money deposit and must be added to the total amount of funds to close. Keep in mind that these costs will vary depending on different factors including the exchange rate at the day of closing.

Escrow Account

The Escrow Account is set up by a Closing Agent when your offer is accepted. Funds for the real estate purchase, including remaining down-payment, loan proceeds, and closing costs are deposited into the Escrow Account prior to closing. The Escrow funds are then disbursed at the time of closing based on specific disbursement instructions which are prepared prior to closing.

Bank Trust Fees

Trust Acceptance Fee

This is a one-time paid to your Bank fee to set up your Bank Trust.

Trust First Year Fee

Paid to the Bank to maintain the Fideicomiso, the first years’ fee must be paid in advance.

Foreign Affairs Permit

(SRE – Secretaría de Relaciones Exteriores)

This is a permit that the Notario or the Trustee Bank process through the Closing Agent which allows you to purchase the property.

National Foreign Investments Registration

(RNIE – Registro Nacional de Inversiones Extranjeras)

The Trustee Bank has the obligation to register the Deed within 30 days after issuing it.

Notario Fees

These fees are regulated by a fee list authorized by the Notary Law.

Property Acquisition Tax

(ISABI – Impuesto Sobre Adquisición de Bienes Inmuebles)

Paid to the municipality by the Buyer, the Real Property Transfer Tax is the equivalent of 2% of the property’s purchase price.

Public Registry Rights

(RPPC – Registro Público de la Propiedad y Comercio)

This permit is based on the sales price of your property. Once the fee is paid, the Notario will process the registration in the Local Public Registration Office.

No Liens Certificate

(Certificados de Libertad de Gravámenes)

The Notario has the obligation to check that the subject property has no liens on property tax, water or HOA fees.

Other Charges

Appraisal for tax assessment (Avalúo): This is used exclusively for tax purposes.

Property Survey (Deslinde): This is a sketch showing the property boundaries and physical features, like the federal zone, roadways, easements, etc.

Closing Cost Estimate

To clarify, the following chart and table outlines the range that closing costs can be expected to fall into.

| Price | Low | Mid | High | Mid $ |

| $100k | 8.2% | 9.4% | 10.7% | $9,400 |

| $150k | 6.4% | 7.4% | 8.5% | $11,100 |

| $200k | 5.5% | 6.3% | 7.2% | $12,700 |

| $250k | 5.0% | 5.7% | 6.5% | $14,300 |

| $300k | 4.7% | 5.3% | 6.0% | $16,000 |

| $350k | 4.4% | 5.0% | 5.6% | $17,600 |

| $400k | 4.2% | 4.8% | 5.3% | $19,200 |

| $450k | 4.1% | 4.6% | 5.2% | $20,800 |

| $500k | 4.0% | 4.5% | 5.0% | $22,600 |

| $550k | 3.9% | 4.3% | 4.6% | $23,500 |

| $600k | 3.8% | 4.2% | 4.6% | $25,100 |

| $650k | 3.7% | 4.1% | 4.5% | $26,800 |

| $700k | 3.7% | 4.1% | 4.5% | $28,600 |

| $750k | 3.6% | 4.0% | 4.4% | $30,100 |

| $800k | 3.6% | 4.0% | 4.4% | $31,800 |

| $850k | 3.6% | 3.9% | 4.2% | $33,200 |

| $900k | 3.5% | 3.9% | 4.2% | $34,900 |

| $950k | 3.5% | 3.8% | 4.2% | $36,500 |

| $1 m | 3.5% | 3.8% | 4.2% | $38,100 |

| $1.25 m | 3.4% | 3.6% | 3.9% | $45,500 |

| $1.50 m | 3.3% | 3.6% | 3.9% | $53,700 |

| $1.75 m | 3.3% | 3.5% | 3.7% | $61,300 |

| $2 m | 3.2% | 3.5% | 3.7% | $69,300 |

| $3 m | 3.1% | 3.4% | 3.6% | $101,200 |

| $4 m | 3.1% | 3.3% | 3.5% | $131,900 |

| $5 m | 3.1% | 3.3% | 3.5% | $163,700 |

| $6 m | 3.0% | 3.2% | 3.4% | $193,600 |

| $7 m | 3.0% | 3.2% | 3.4% | $225,000 |

| $8 m | 3.0% | 3.2% | 3.4% | $256,400 |

| $9 m | 3.0% | 3.2% | 3.4% | $287,900 |

| $10 m | 3.0% | 3.2% | 3.4% | $319,300 |